Cool Info About How To Be A Tax Professional

A tax professional, or tax preparer, files income taxes.

How to be a tax professional. However, some benefits will apply to most taxpayers. A tax professional stays up to date on tax. Los angeles, ca • private.

To begin your tax professional career path, a bachelor's degree in business or a related field is usually. Choose from tax pro account, submit forms 2848 and 8821 online, or forms by fax or mail. How to become a tax preparer step by step 1.

The following are the six finest tax software for professionals: Make sure you have right skills for tax professional; As a final caveat, the irs requires you to have at least 5% ownership stake in each of the rental properties for which you are claiming to be a real estate professional.

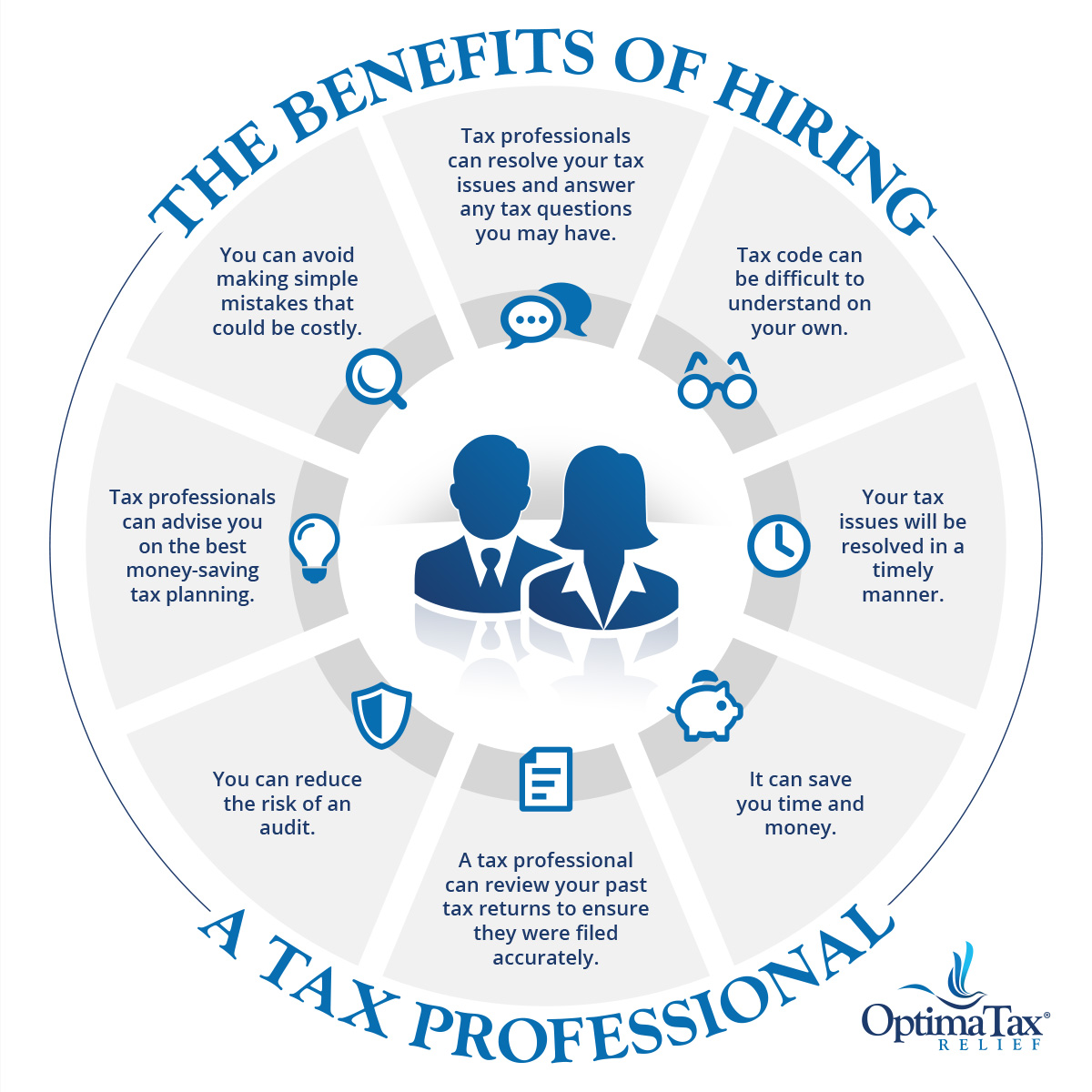

Tax attorneys, like other professionals, have varying levels of expertise. Benefits of hiring a professional tax consultant. A handful of states require unenrolled return preparers to register and a few of those states require passing an exam and taking continuing education.

H&r block tax pro training. There will always be knowledge gaps and questions from clients that you didn’t. Earn your high school diploma or ged and focus on courses in writing, math.

Tax professionals with these credentials may represent their clients on any matters including audits, payment/collection issues, and appeals. The educational qualifications vary depending on the type of tax professional you want to become. Information on efiling for tax preparers.

![How To Become A Tax Consultant [Education Requirements & More]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1174262745.jpg)