Favorite Info About How To Reduce Cost Of Capital

How can a company lower its weighted average cost of capital?

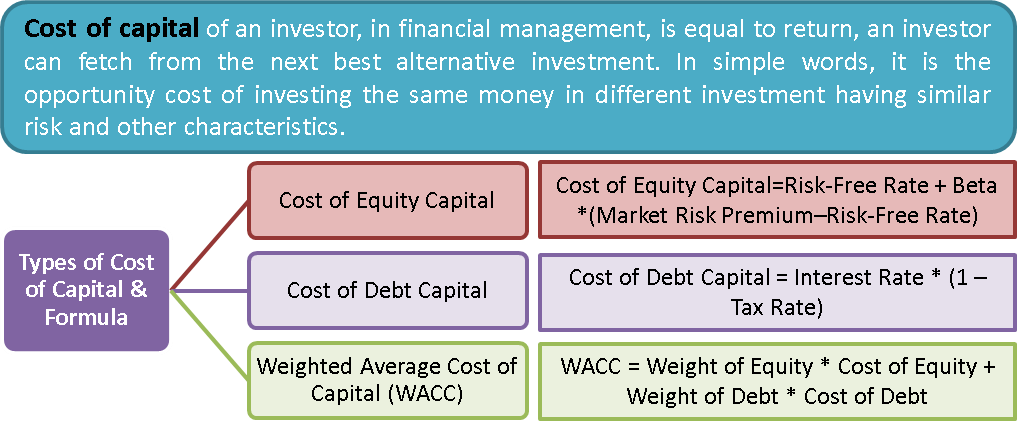

How to reduce cost of capital. The company can reduce capital by employing one of the following methods: To reduce the cost of capital, companies can reduce the amount of dividend payments, but this can have a negative impact on falling share prices. The total cost of capital.

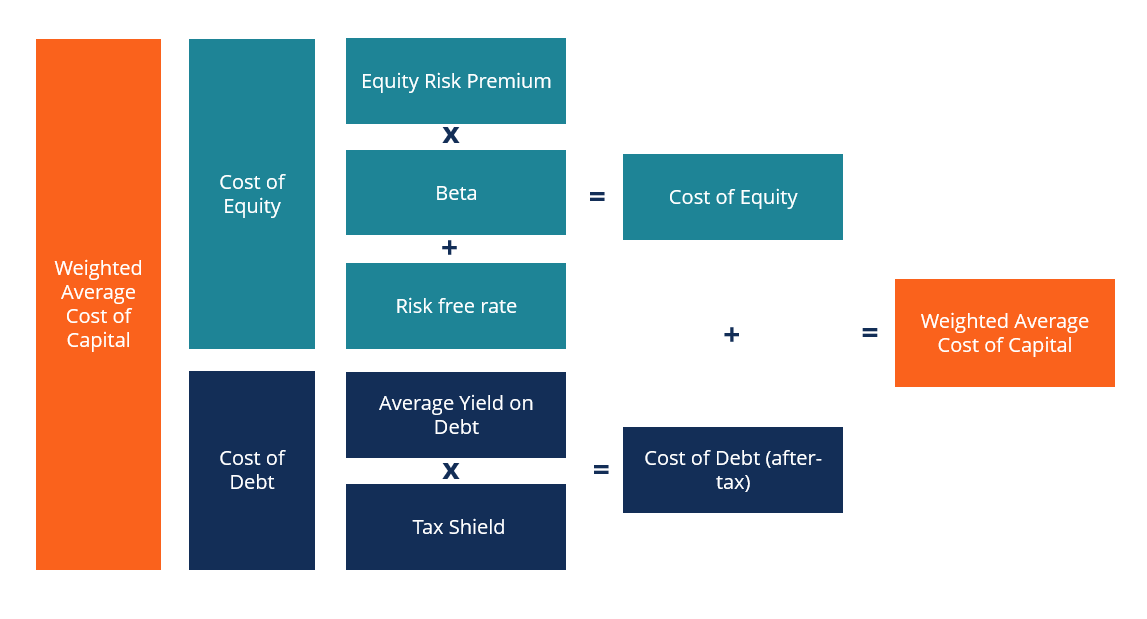

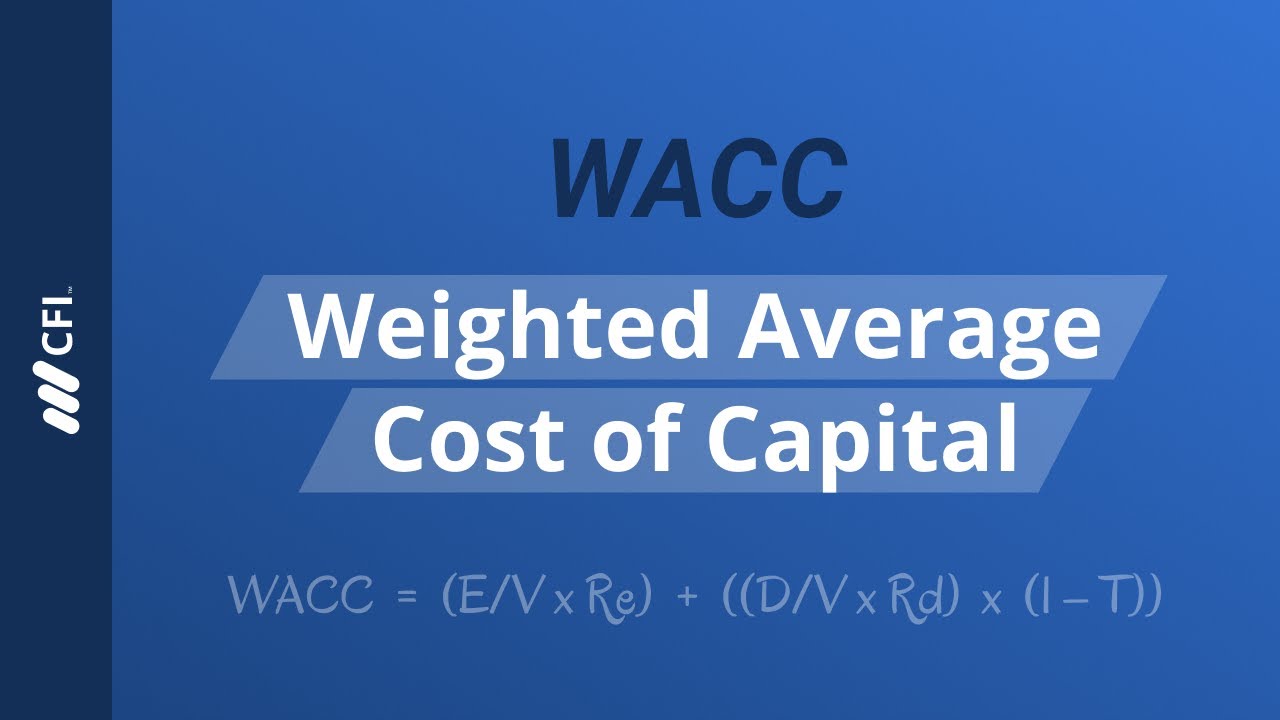

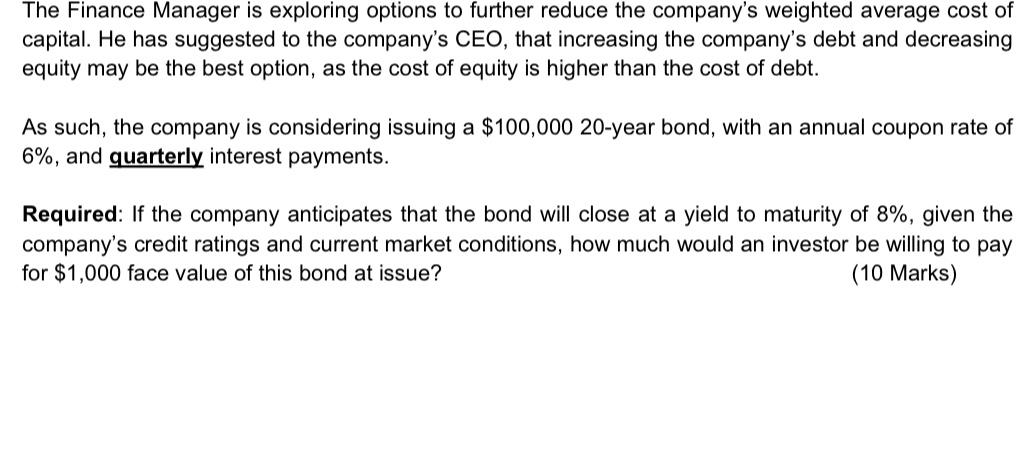

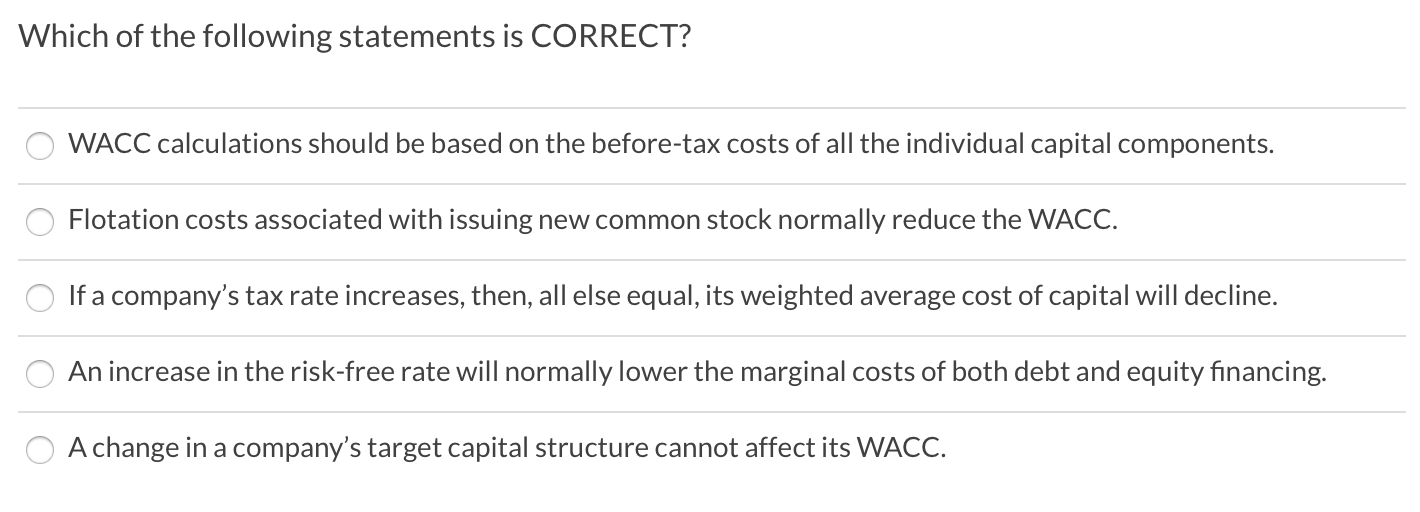

The most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). (1) lower the cost of equity or (2) change the capital structure to include more debt. Given that the cost of capital reflects the current market price of stock in the.

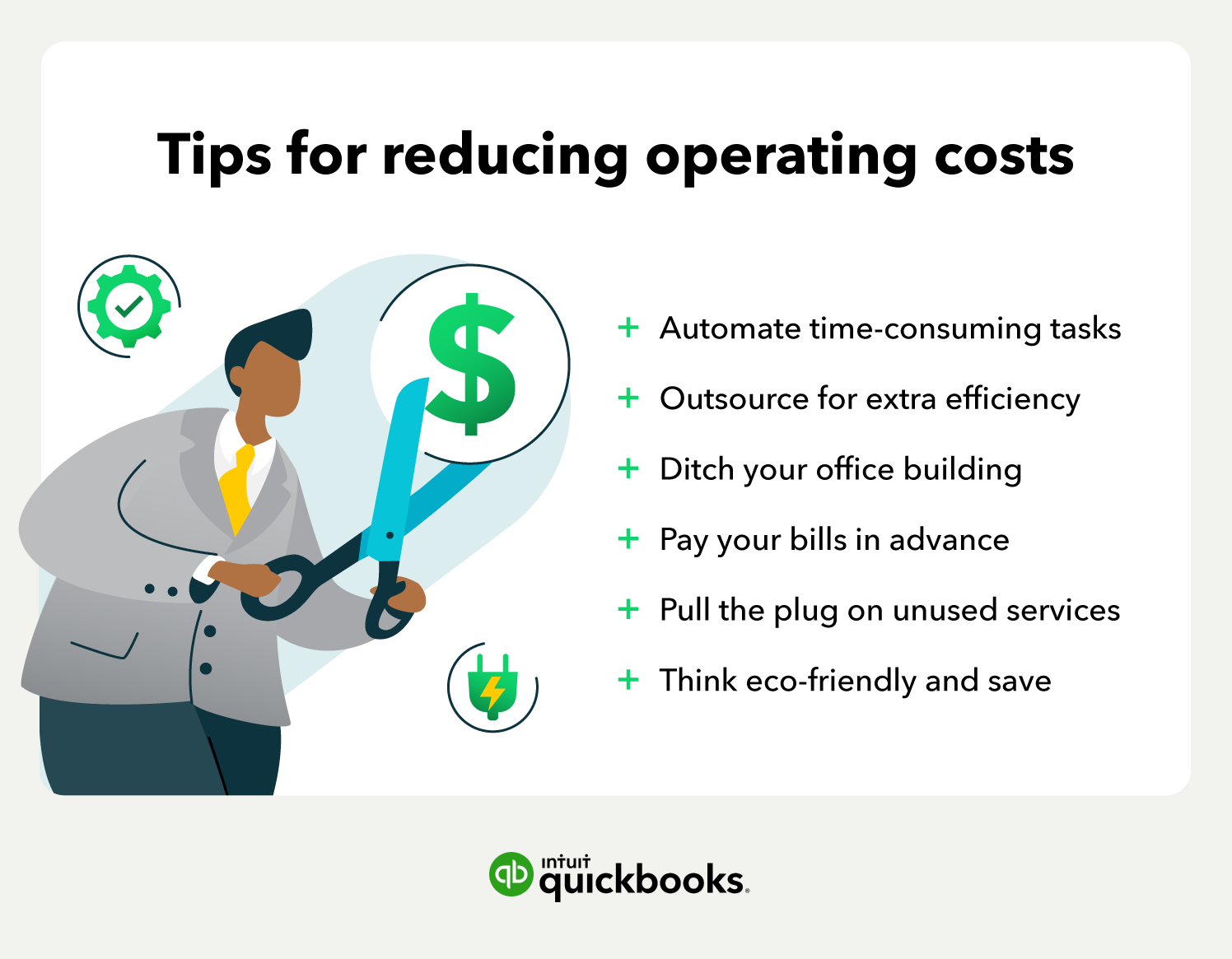

Procurement costs—the largest expenditure—can account for. How to reduce project capital costs and increase profitability overview. Specifically, to buy the stock, they.

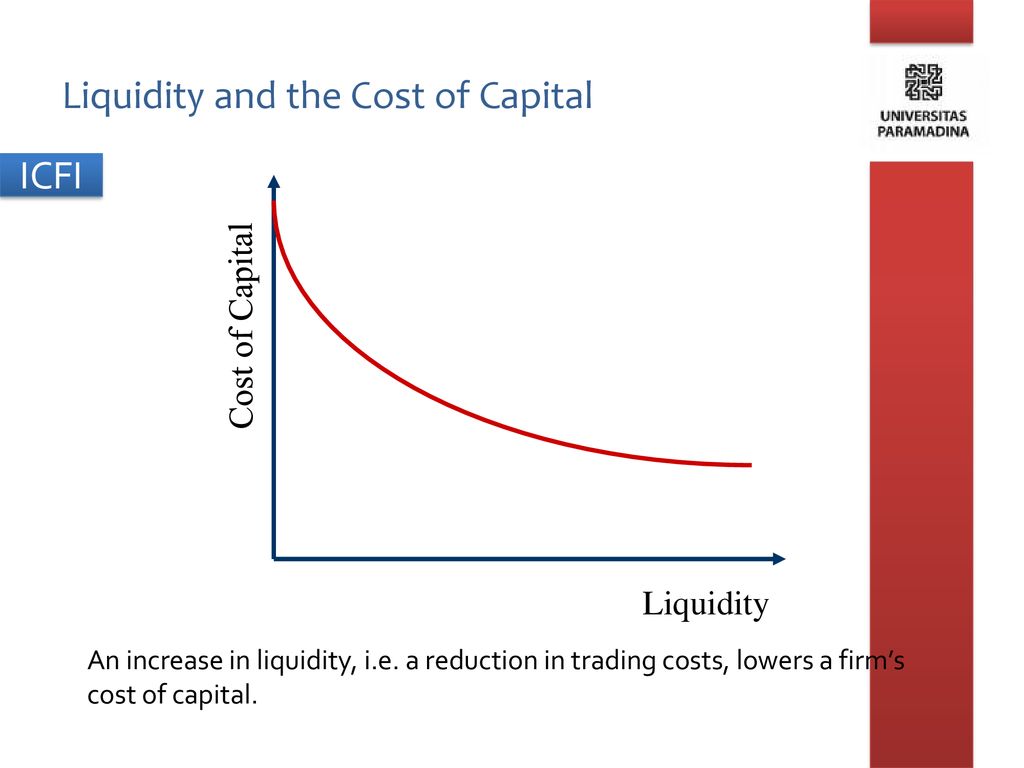

Under this method, all sources of financing are. Trade activity economic boom and recession also play a. No cost is too small to worry about.

See every cost as “up for grabs”. Equity cost is the return on investments that shareholders expect to earn from the company. Since the cost of equity reflects the risk associated with.

On the ratings side, this is probably a bad thing, because it indicates. Investors who buy stocks expect a particular rate of return. The most effective ways to reduce the wacc are to:

/COST-OF-CAPITAL-FINAL-HR-f3d41d21c66a494ea77eec360a6a3857.jpg)