Build A Info About How To Buy Ipo

/GettyImages-1045262938-d6e77886128f4b05b3b4b4e3daef781a.jpg)

An ipo is an initial public offering.

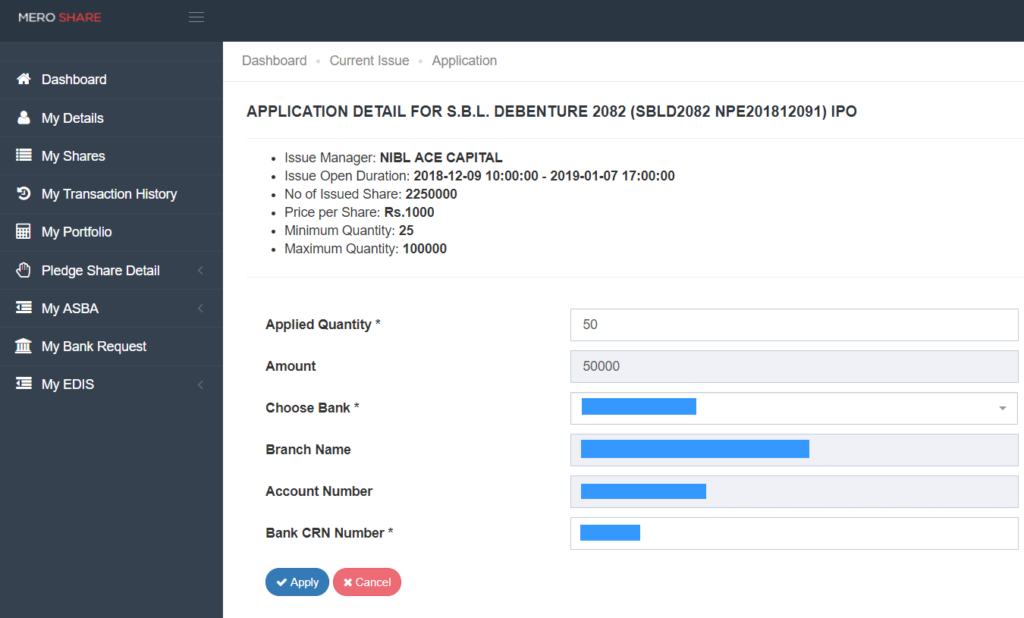

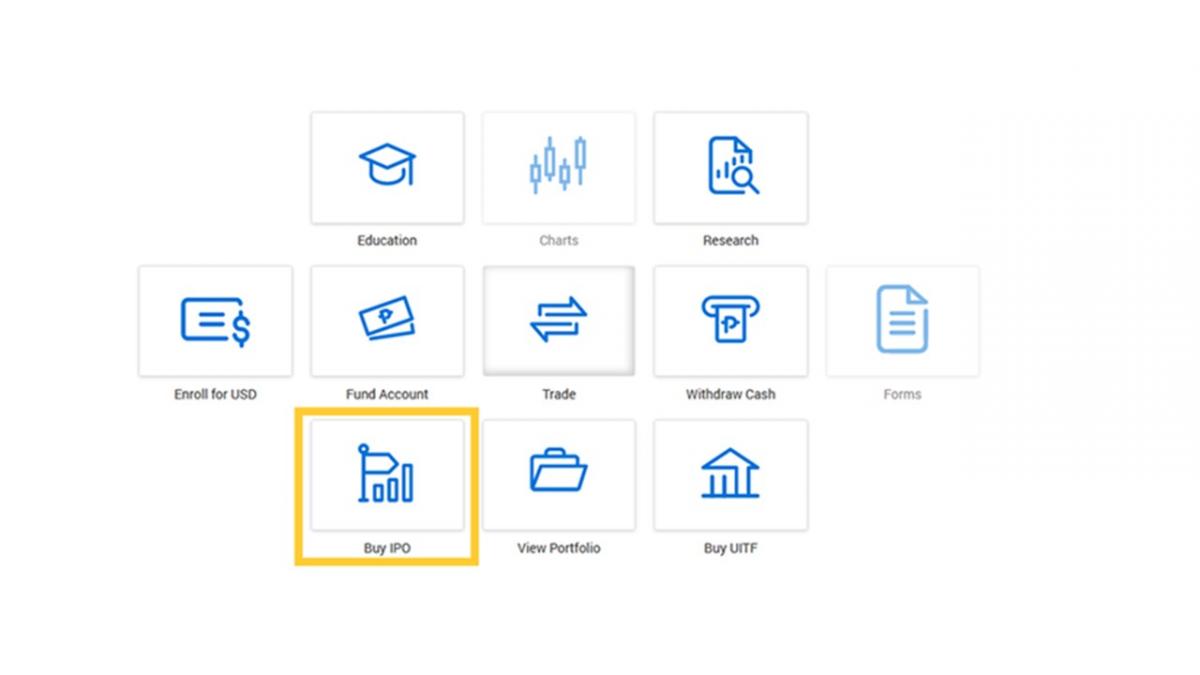

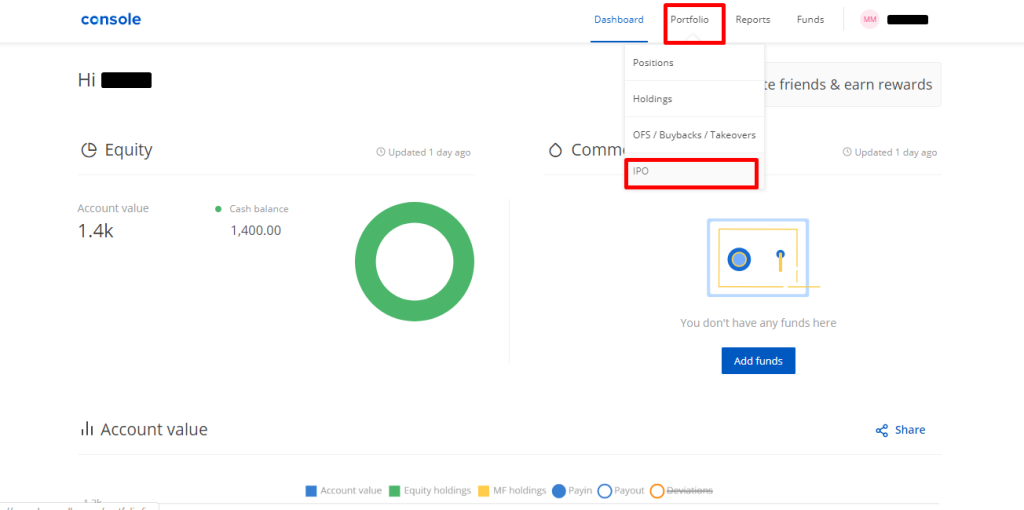

How to buy ipo. An initial public offering, or an ipo, is a company's first offering of stock to the public. Apply online and invest in companies listing on the indian exchanges with an ipo (initial public offering) using mobile upi with your zerodha account. To buy into an ipo stock, an investor must have a brokerage account, be eligible for purchase, and shares must be available.

The risks of buying ipo stock while 2021 was a big year for ipos, 2022 looks to have significantly fewer ipos. Most popular brokerage firms like td ameritrade, robinhood and fidelity offer ipo. An initial public offering (ipo) is the first time the general public can buy shares in a company that goes public.

Buying an ipo first starts with having a brokerage account. Until a company goes public, individual investors are mostly unable to invest in the company. For example, fidelity requires investable assets ranging from at least $100,000 to $500,000 to participate in an ipo.

But other brokerages, like sofi, require a minimum of just. Low commissions, advanced trading platforms and access to research. Have an account with a participating broker.

If the stock is priced at $10 per share, you’ll pay $10 per share — no. Read more about how it works. Learn more about trading ipo stocks.

Company founders often use ipos to create an influx of capital to help them pay off debt, fund new growth, or create excitement for the company with the general public. To buy an ipo stock, you must have an account with a broker that offers ipo trading. How to buy ipo stock 1.